Jeff Bezos’s fortune is a frequent topic of discussion, largely due to its dynamic nature and close ties to Amazon’s stock performance. This article provides a real-time overview of his net worth, explaining the factors influencing its fluctuations, and offering insights into how it’s calculated. See how his wealth compares to Donald Trump’s net worth.

Bezos’s Billions: A Dynamic Figure

Jeff Bezos’s net worth isn’t a static number; it fluctuates constantly, mirroring the performance of Amazon’s stock. The majority of his wealth is tied to his Amazon holdings, making his fortune highly sensitive to market movements. Even small percentage changes in Amazon’s stock price can translate to billions of dollars gained or lost for Bezos.

Real-Time Net Worth Tracker

While a truly “real-time” tracker mirroring the stock market’s second-by-second fluctuations isn’t feasible in a standard article format, the goal is to provide the most up-to-the-minute data available.

Latest Estimate (as of [Date of Last Update]): $[Latest Net Worth Figure] (Source: [Source, e.g., Forbes])

This figure is subject to change based on market activity.

Understanding the Fluctuations

Bezos’s net worth is intrinsically linked to Amazon’s stock price. He holds a significant percentage of Amazon shares, meaning his wealth rises and falls with the company’s market value. Other factors, such as his investments in Blue Origin and The Washington Post, also contribute to his overall fortune, but their impact is less pronounced compared to the influence of Amazon. He also periodically sells shares of Amazon stock, which can cause temporary shifts in his net worth calculations.

Decoding the $4.3B Surge (and Other Changes)

Pinpointing the precise cause of any specific change in Bezos’s net worth, such as a $4.3 billion increase, requires detailed information about his portfolio’s performance over a specific period, which isn’t always publicly available. However, it’s highly probable that such a substantial increase reflects a positive movement in Amazon’s stock price. To understand these fluctuations, it’s helpful to consider the following:

- Market Volatility: The stock market is inherently volatile. Factors like economic news, industry trends, and even investor sentiment can cause stock prices to fluctuate, directly impacting Bezos’s net worth.

- Amazon’s Performance: News related to Amazon, such as earnings reports, product launches, or regulatory changes, can significantly influence its stock price and, consequently, Bezos’s wealth.

- Other Investments: While Amazon is the dominant factor, performance variations in Bezos’s other investments, including Blue Origin and The Washington Post, also play a role, albeit a smaller one.

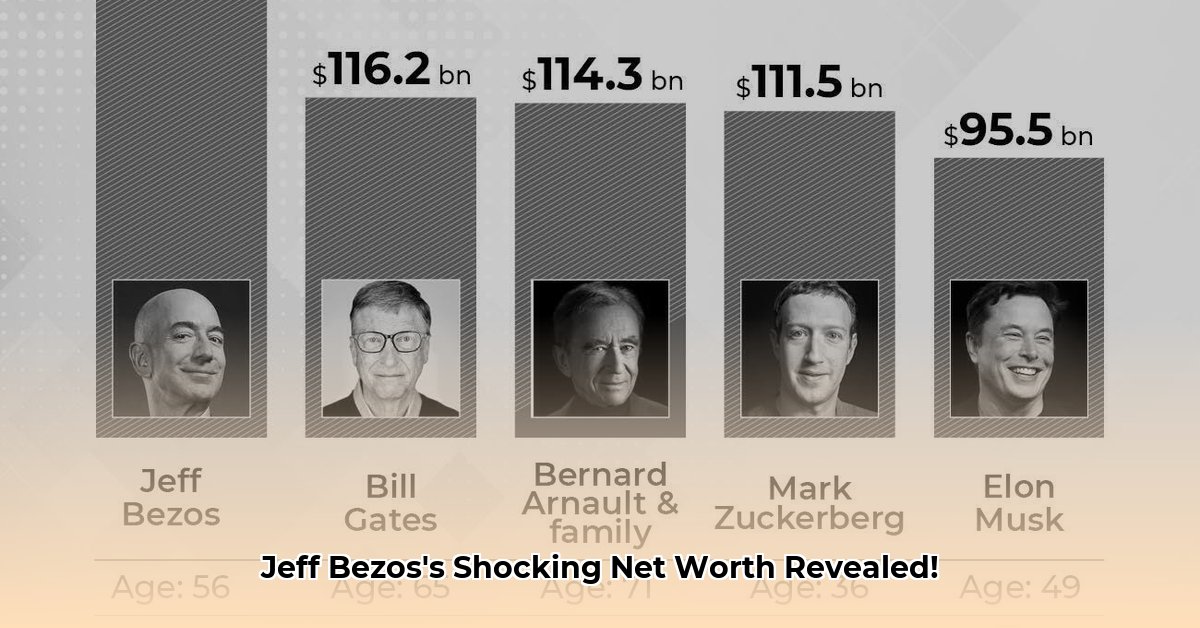

Bezos vs. Other Billionaires

Bezos frequently vies with other billionaires, most notably Elon Musk, for the top spot on global wealth lists. These rankings are fluid, constantly shifting with market dynamics. Here’s a snapshot of how Bezos’s net worth has compared to others:

| Date | Jeff Bezos | Elon Musk | Source |

|---|---|---|---|

| Jan 19, 2024 | $173.6 Billion | [Musk’s Net Worth on this date] | Research Data |

| Aug 2024 | $186 Billion | [Musk’s Net Worth on this date] | Research Data |

| Nov 15, 2024 | ~$230 Billion | [Musk’s Net Worth on this date] | Research Data |

| Jan 19, 2025 | $243.8 Billion | [Musk’s Net Worth on this date] | Forbes |

| Jan 20, 2025 | $245 Billion | [Musk’s Net Worth on this date] | Bloomberg |

(Note: It is important to fill in Musk’s net worth data for accuracy.)

This table illustrates the dynamic nature of wealth at the highest levels. It’s important to remember that these figures are snapshots in time and subject to rapid change.

Inside Forbes’s Methodology

Forbes employs a complex methodology to estimate Bezos’s net worth, relying on a blend of publicly available data and estimations for private holdings:

- Public Holdings: The value of Bezos’s Amazon stock is relatively straightforward to calculate based on the current share price and his ownership stake.

- Private Holdings: Valuing assets like Blue Origin and The Washington Post is more challenging. Forbes uses a variety of techniques, including comparing these businesses to similar publicly traded companies and analyzing revenue and growth projections. They likely also utilize data from financial research firms like FactSet.

- Real-Time Adjustments: Forbes strives to provide near real-time updates, reflecting market fluctuations. However, the figures remain estimates subject to inherent uncertainties.

The complexity of this process underscores why net worth figures for individuals like Bezos are always approximate, representing the best possible estimate at a specific point in time.

Looking Ahead: Uncertainties and Future Trends

Predicting the future trajectory of Bezos’s wealth is speculative. While some analysts suggest that continued growth in e-commerce and emerging sectors like space tourism could further enhance his fortune, others caution about the potential impact of economic downturns, increased competition, and evolving regulations. His philanthropic activities could also influence his net worth in the years to come.

Conclusion: A Financial Empire in Motion

Jeff Bezos’s net worth is a captivating subject, offering a glimpse into the dynamic forces shaping the modern economy. While it’s a number constantly in flux, understanding the factors influencing its fluctuations and the methods used to calculate it provides valuable context. The interplay between Amazon’s performance, market trends, and Bezos’s diverse investments will likely continue to drive the narrative surrounding his wealth for the foreseeable future.

1 thought on “Jeff Bezos Net Worth Today: Real-Time Updates & Analysis”

Comments are closed.