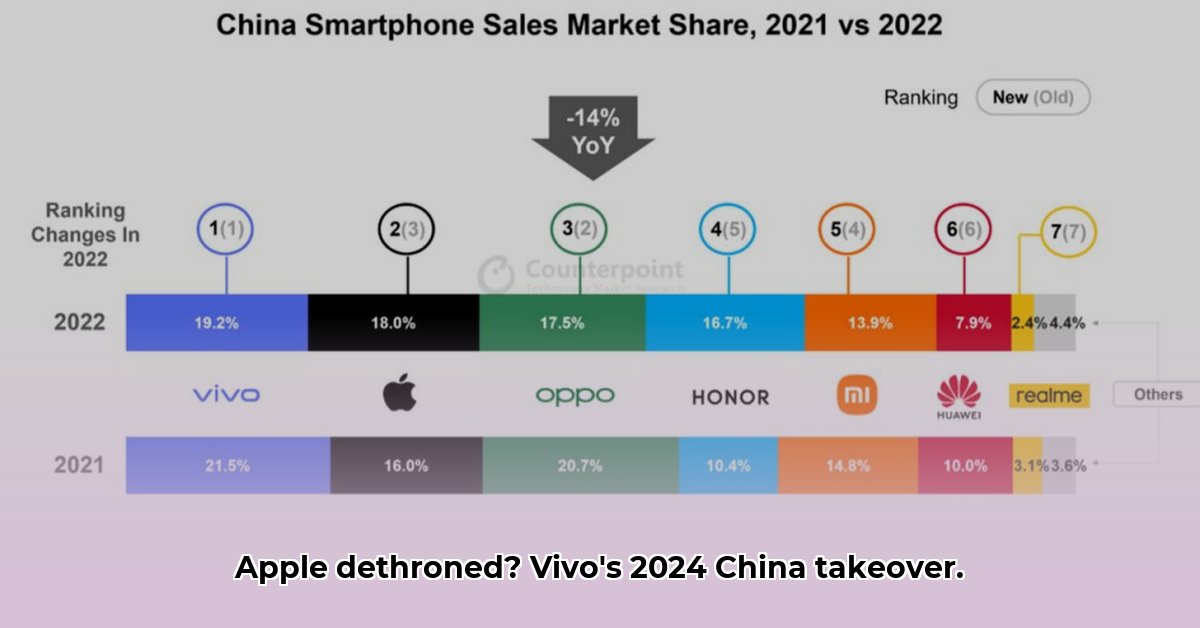

Vivo Reigns Supreme: Apple Falls to Third in China’s Smartphone Market

Apple’s reign atop China’s smartphone market has ended. In a significant market shift, Vivo claimed the top spot in 2024, relegating Apple to third place. Huawei’s resurgence further compounded Apple’s woes, securing second place. This dramatic reshuffling underscores the evolving dynamics of the Chinese market and raises questions about Apple’s future strategy in this crucial region. Apple’s 15% market share reflects a 17% annual shipment decline, its steepest drop ever in China.

Deconstructing Apple’s Decline: A Confluence of Factors

Several factors contributed to Apple’s stumble in the Chinese market. Domestic brands, particularly Vivo, successfully capitalized on the growing demand for affordable yet feature-rich devices. Vivo’s strategy of offering competitive pricing combined with attractive features resonated strongly with Chinese consumers. This, combined with Huawei’s resurgence, created a formidable challenge for Apple.

Huawei, despite facing ongoing challenges, achieved a remarkable comeback, capturing 16% of the market. Its growth was fueled by a 24% surge in fourth-quarter shipments, signaling renewed consumer confidence in the brand. Huawei’s success can likely be attributed to its resilience and focus on domestically produced technology.

Apple’s struggles may be linked to its premium pricing strategy in an increasingly price-sensitive market. The iPhone 16 series, while technologically advanced, might not be considered innovative or offer a “wow” factor in comparison to the features being offered by Chinese vendors like Vivo and Huawei. Its relatively high price made it less attractive to budget-conscious consumers. The lack of access to services like ChatGPT in China may have also influenced consumer decisions.

Furthermore, the rising popularity of foldable phones and advanced AI features presents a challenge for Apple. Chinese brands have aggressively pursued these trends, while Apple has yet to fully embrace them. This divergence may explain some of the shift in consumer preferences.

Apple’s Counteroffensive: Discounts and the Road Ahead

Apple responded to declining sales with unprecedented discounts on its iPhone 16 models. While these discounts could temporarily boost sales, their long-term effectiveness and potential impact on brand perception remain uncertain. Some analysts suggest that deeper strategic changes may be necessary for Apple to regain its lost ground.

| Brand | Q4 2024 Shipment Change | 2024 Market Share |

|---|---|---|

| Vivo | 14% increase | 17% |

| Huawei | 24% increase | 16% |

| Apple | 25% decrease | 15% |

| Xiaomi | 29% increase | Data Not Available |

| Oppo | 18% increase | Data Not Available |

The Future of the Chinese Smartphone Battlefield

The Chinese smartphone market is highly dynamic and competitive. Vivo’s ascent, Huawei’s resurgence, and Apple’s decline signal a significant power shift. The future likely holds further surprises. Whether Apple can adapt to the evolving market dynamics and reclaim its leading position remains to be seen. Ongoing market analysis will be crucial in understanding these evolving trends.

Vivo’s Winning Strategy: A Deep Dive

Vivo’s success can likely be attributed to its strategic focus on providing value to the consumer. By combining attractive features with competitive pricing, they have successfully captured a large segment of the price-conscious market. This approach suggests that a significant portion of Chinese consumers prioritize affordability without compromising on functionality.

| Feature | Vivo/Huawei | Apple |

|---|---|---|

| Foldable Phones | Strong Adoption | Limited Presence |

| AI Integration | Emerging | Catching Up |

| Domestic Chipsets | Advantage | Reliance on Imports |

| Price Competitiveness | Advantage | Premium Pricing |

The Global Impact of Apple’s China Slump

Apple’s struggles in China have had a ripple effect on its global performance. The company reported a 5% decline in global iPhone sales in Q4 2024. China’s substantial contribution to Apple’s revenue makes this market contraction a significant concern. The situation raises questions about Apple’s global strategy and its ability to compete with increasingly strong international rivals. Analysts suggest that Apple needs to adapt its strategies to remain competitive in the evolving global market.

| Company | Market Share (2024) |

|---|---|

| Vivo | 17% |

| Huawei | 16% |

| Apple | 15% |

| Oppo | 15% |

| Honor | 15% |

It’s important to remember that market dynamics are constantly in flux. New data and analysis may offer additional insights into Apple’s position and the overall competitive landscape. While the present situation appears challenging for Apple, its long-term trajectory remains uncertain. Apple’s ability to innovate and respond to changing consumer preferences may prove crucial in the years ahead.