Understanding Alberta’s Vaping Tax

Alberta introduced a new tax on vaping products, effective January 1, 2025. This tax applies to e-liquids (vape juice) and is designed to discourage vaping, especially among young people, while also generating revenue for the province. It’s important to understand that this tax is separate from your electricity bill and the Regulated Rate of Last Resort (RLR). The RLR is a price protection measure for electricity, unrelated to vaping products.

Calculating the Tax: A Tiered Approach

The Alberta vaping tax uses a tiered system, meaning the tax rate changes depending on the volume of vape juice purchased. This tiered structure may be intended to discourage the purchase of larger quantities, potentially targeting heavier users.

Tier 1 (First 10 mL): $1.12 per 2 mL (effectively $0.56/mL)

Tier 2 (Amounts over 10 mL): $1.12 per 10 mL

Let’s break down some examples:

| Vape Juice Volume (mL) | Tax Calculation | Total Tax |

|---|---|---|

| 2 | $1.12 | $1.12 |

| 10 | $1.12/2 mL * 5 | $5.60 |

| 20 | $5.60 + ($1.12) | $6.72 |

| 30 | $5.60 + ($1.12 * 2) | $7.84 |

| 60 | $5.60 + ($1.12 * 5) | $11.20 |

| 100 | $5.60 + ($1.12 * 9) | $15.68 |

This table demonstrates how the tax increases with volume, but the rate of increase shifts after the first 10 mL. Keep in mind that this provincial tax is in addition to the existing federal vaping tax.

Frequently Asked Questions

General Questions

-

Q: When did the Alberta vaping tax go into effect?

- A: January 1, 2025.

-

Q: Does the vaping tax apply to all vaping products?

- A: Currently, the provincial tax applies only to e-liquids (vape juice). Devices, accessories, and other vaping-related products are not subject to this specific provincial tax, but it’s advisable to check for updates, as future legislation might expand the scope.

-

Q: Where can I find official information?

- A: The Government of Alberta website is the most reliable source for details on the vaping tax and related regulations.

-

Q: What are the penalties for non-compliance?

- A: Retailers who fail to collect and remit the tax can face penalties and fines. Consult the official government resources for specifics.

-

Q: Are there any exemptions from the tax?

- A: Currently, there are no provincial exemptions. Always check the latest government information for potential changes.

Tax Calculation & Electricity Rates

-

Q: How is the tax calculated?

- A: The tax is calculated using a tiered system explained in detail above. A table is provided for quick reference.

-

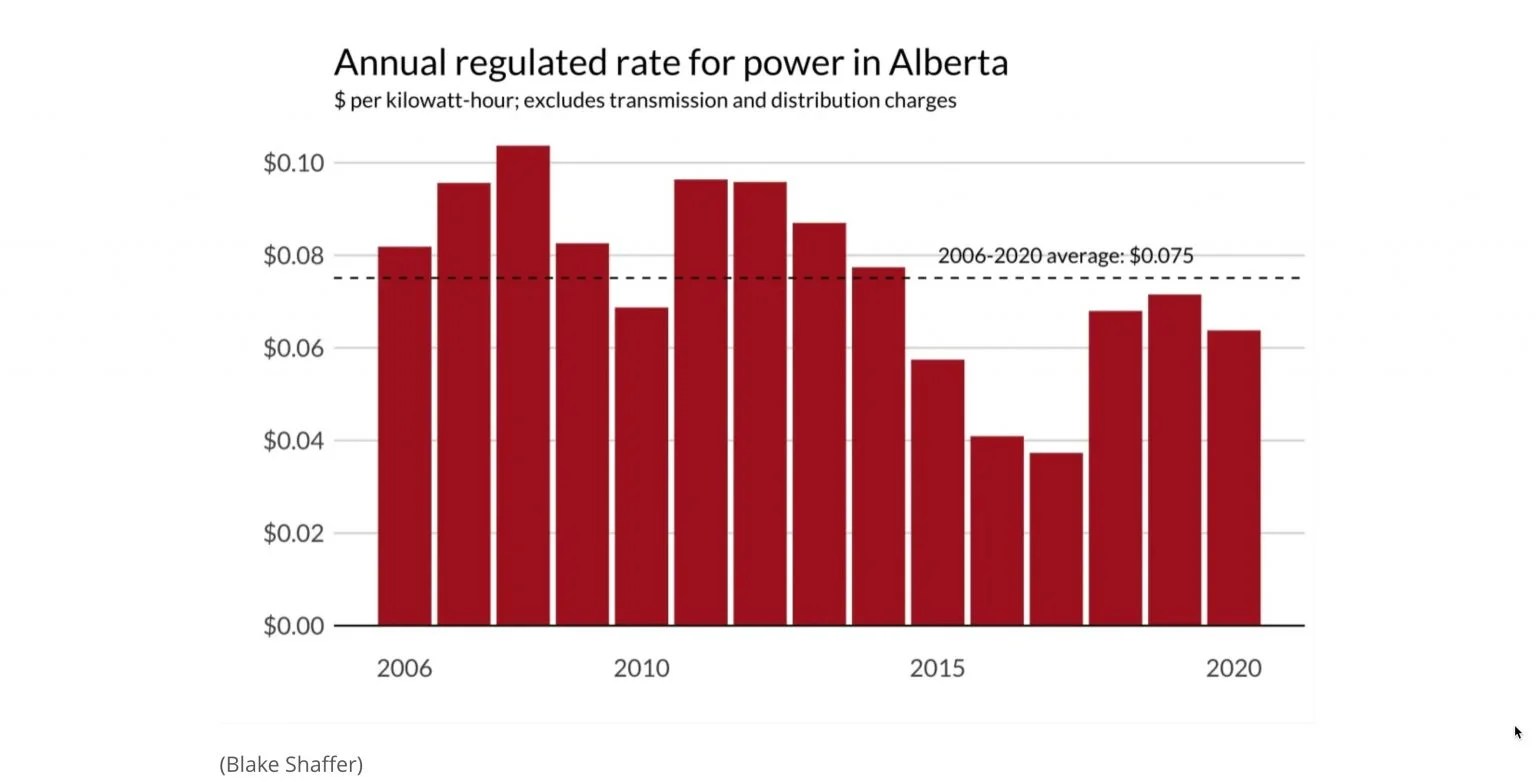

Q: Is the vaping tax related to my electricity bill?

- A: No. This is a common misconception. The vaping tax and electricity rates are entirely separate. The vaping tax is a consumption tax on vape products, while your electricity bill covers your energy usage. The Regulated Rate of Last Resort (RLR) for electricity, a price protection measure, is also unrelated to the vaping tax.

Potential Impacts and Future Implications

The long-term effects of the Alberta vaping tax are still being studied.

- Youth Vaping: Will the tax effectively reduce youth vaping rates? Some experts believe it might, but others suggest it may not be sufficient on its own. Comprehensive public health strategies often require multiple approaches.

- Black Market: Could the tax lead to a rise in the black market for vaping products? It’s a possibility that authorities will need to monitor closely.

- Small Businesses: How will the tax affect vape shops and the broader vaping industry in Alberta? Some businesses may struggle to adapt to increased prices, potentially impacting product availability and consumer choices.

- Traditional Cigarette Use: Will vapers switch back to traditional cigarettes due to increased vaping costs? This is another area where ongoing research is needed.

Federal Vaping Taxes

Remember, in addition to the provincial tax, there’s a separate federal tax on vaping products. For details about the federal tax, visit the Government of Canada website.

Additional Resources

For more in-depth information, consult the following resources:

This guide provides a comprehensive overview of the Alberta vaping tax. Remember that regulations and research are constantly evolving. Stay informed by consulting official government resources for the latest updates.