This guide provides a detailed overview of the 2025 federal income tax brackets in Canada, as established by the Canada Revenue Agency (CRA). It includes explanations of key terms, example calculations, and answers to frequently asked questions. This information is current as of October 26, 2023 but may be subject to change. Always verify with the CRA website for the most up-to-date information.

Understanding the Federal Tax System

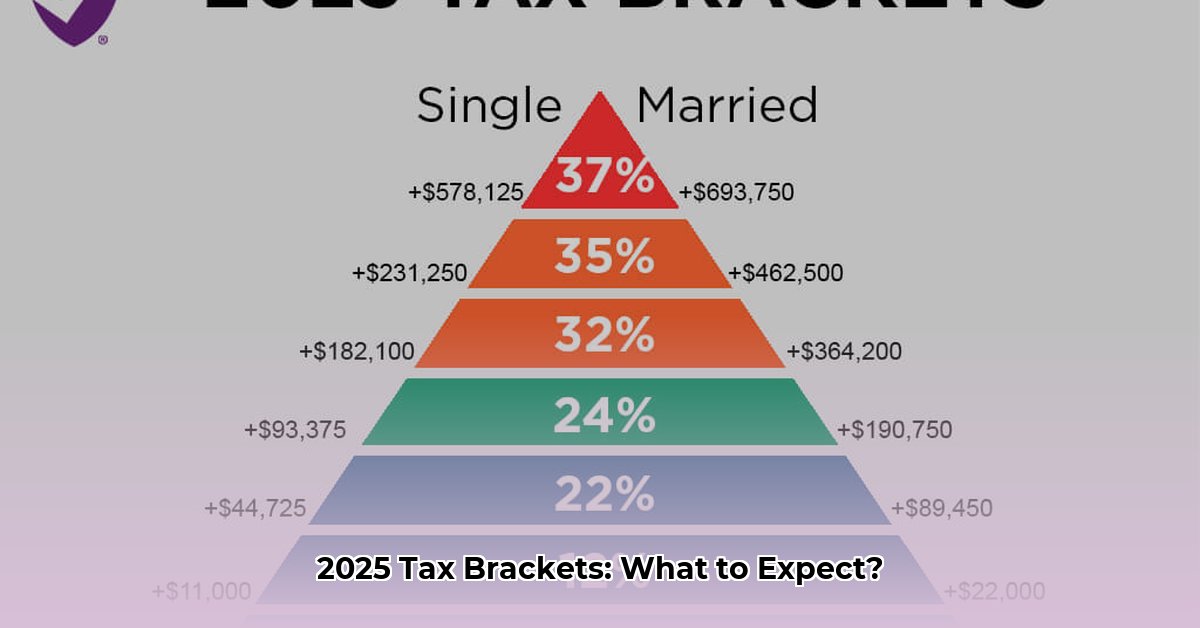

Canada’s federal income tax system operates on a progressive, tiered structure. This means that higher portions of your income are taxed at progressively higher rates. Understanding these brackets is essential for financial planning and accurately estimating your tax liability. The brackets are subject to annual indexation to account for inflation, as measured by the Consumer Price Index (CPI).

2025 Federal Tax Brackets and Rates

The following table presents the anticipated federal income tax brackets and rates for 2025, indexed by 2.7% based on the CPI:

| Income Range | Tax Rate |

|---|---|

| Up to $57,375 | 15% |

| $57,375.01 to $114,750 | 20.5% |

| $114,750.01 to $177,882 | 26% |

| $177,882.01 to $253,414 | 29% |

| Over $253,414 | 33% |

Key Terms and Concepts

Basic Personal Amount (BPA)

The BPA is a non-taxable portion of income allotted to every taxpayer. For 2025, the BPA is set at $16,129. This amount is subject to a phase-out for higher incomes, beginning to decrease at $177,882 and completely phasing out at $253,414, leaving a base BPA of $14,538.

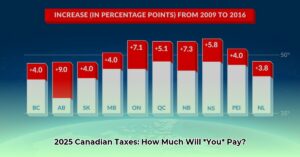

Indexation

Indexation is the annual adjustment of tax brackets and the BPA based on inflation, preventing “bracket creep” where inflation pushes individuals into higher tax brackets without a real increase in purchasing power. The 2025 brackets are indexed by 2.7%, reflecting the CPI increase. Some research suggests that CPI indexation may not fully capture the true impact of inflation on some segments of the population.

Calculating Your 2025 Federal Tax: An Example

Let’s assume an individual earns $80,000 in 2025. Here’s a simplified calculation:

-

Subtract the BPA: $80,000 – $16,129 = $63,871 (Taxable Income)

-

Calculate Tax by Bracket:

- 15% on the first $57,375: $57,375 * 0.15 = $8,606.25

- 20.5% on the remaining $6,496 ($63,871 – $57,375): $6,496 * 0.205 = $1,331.68

-

Total Federal Tax: $8,606.25 + $1,331.68 = $9,937.93

This is a simplified illustration. Actual tax calculations can be more complex, involving various deductions and credits. Using tax software or consulting a tax professional is recommended for accurate calculations.

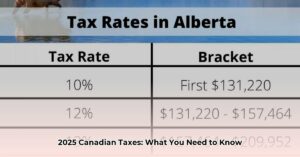

Provincial/Territorial Taxes

Remember, these are federal tax brackets. You will also owe provincial or territorial income tax. These rates and rules vary by region. Consult your province or territory’s website for specific information.

Frequently Asked Questions (FAQ)

- Q: Are these rates final? A: These rates are based on current legislation and indexation as of October 26, 2023. It is always advisable to consult the CRA for the most up-to-date information closer to the 2025 tax year.

- Q: What if my income is very low? A: If your income is below the BPA, you may not owe any federal income tax. However, provincial taxes may still apply.

- Q: Where can I find my provincial tax rates? A: You can find provincial/territorial tax information on the website of your province or territory’s revenue agency.

Disclaimer

This information is for general guidance only and does not constitute professional tax advice. For personalized advice, consult with a qualified tax professional.