This guide provides a clear overview of the projected federal income tax brackets and rates for the 2025 tax year in Canada. As of November 2024, these projections are based on the anticipated 2.7% indexation factor applied to the 2024 rates to account for inflation. Remember, these figures are subject to change. Always consult the official Canada Revenue Agency (CRA) website for the most up-to-date information.

Key Changes for 2025 (Projected)

The 2025 federal tax brackets are expected to be adjusted upwards by approximately 2.7% due to indexation. This means the income thresholds for each bracket will likely be slightly higher than in 2024, mitigating the impact of inflation on your tax burden. However, the actual tax rates themselves are not expected to change.

2025 Federal Income Tax Brackets (Projected)

| Income Range | Tax Rate |

|---|---|

| Up to $57,375 | 15% |

| $57,376 to $114,750 | 20.5% |

| $114,751 to $177,882 | 26% |

| $177,883 to $253,414 | 29% |

| Over $253,414 | 33% |

Understanding the Brackets

These are marginal tax rates. This means each portion of your income is taxed at the rate corresponding to its specific bracket. Let’s illustrate with an example:

Example: If your taxable income is $80,000, you would pay:

- 15% on the first $57,375

- 20.5% on the remaining $22,625 ($80,000 – $57,375)

You would not pay 20.5% on the entire $80,000.

Indexation Explained

Indexation adjusts tax brackets annually based on the Consumer Price Index (CPI), reflecting the rising cost of living. The projected 2.7% indexation for 2025 aims to prevent “bracket creep,” where inflation pushes you into a higher tax bracket even though your real purchasing power hasn’t increased.

The Basic Personal Amount (BPA)

The BPA is the amount of income you can earn tax-free. It’s also indexed annually. While the 2025 BPA is yet to be confirmed by the CRA, it’s expected to increase slightly from the 2024 amount. The BPA provides significant tax relief, especially for lower and middle-income earners. However, the BPA benefit is gradually phased out for higher earners and is completely eliminated above a certain income threshold. For details on the BPA phase-out, refer to the CRA website.

Calculating Your 2025 Federal Tax

- Calculate Your Taxable Income: Subtract eligible deductions (RRSP contributions, etc.) from your total income.

- Determine Your Bracket: Find the bracket in the table above that corresponds to your taxable income.

- Calculate Tax for Each Bracket: If your income spans multiple brackets, calculate the tax for the portion of income within each bracket using the corresponding tax rate.

- Total Your Tax: Add the tax amounts calculated in Step 3 to arrive at your estimated federal income tax.

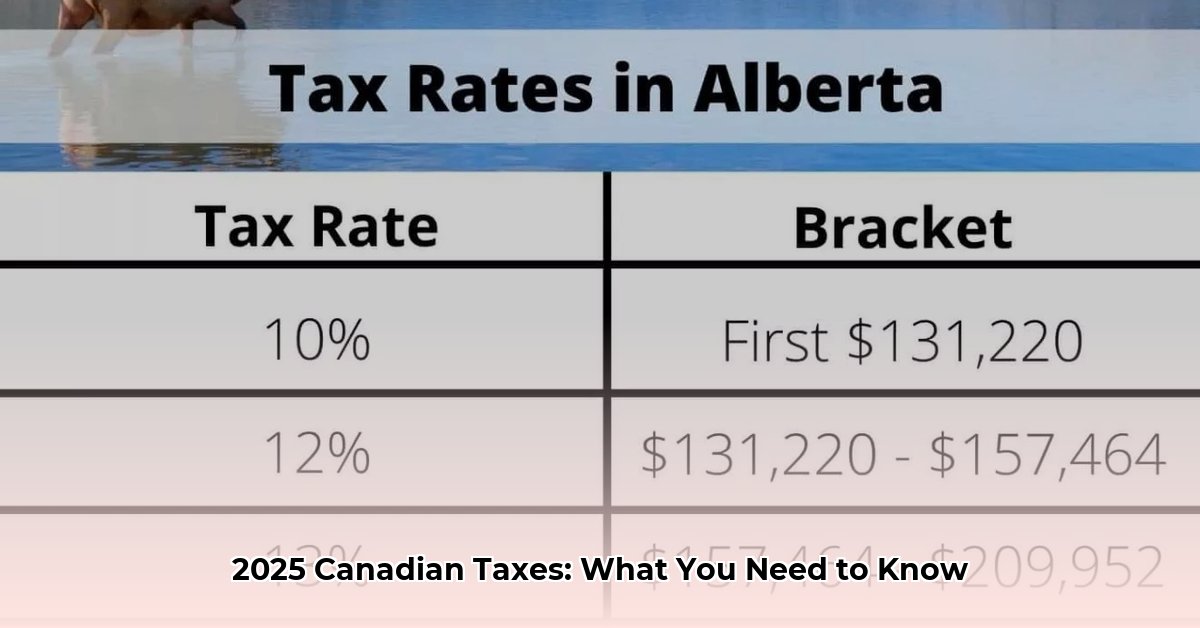

Provincial/Territorial Taxes

Don’t forget! In addition to federal tax, you’ll also pay provincial or territorial income tax. Rates and rules vary by province/territory. Consult your provincial/territorial government’s website for relevant information.

Capital Gains and Other Considerations

For gains realized after June 24, 2024, exceeding $250,000 for individuals, the capital gains inclusion rate is 66 2/3%. Other factors, like eligible deductions and credits, can significantly affect your final tax bill. Consult a qualified tax professional for personalized advice. They can help with complex situations involving capital gains, investments, and other unique financial circumstances. The CRA website also offers resources on capital gains

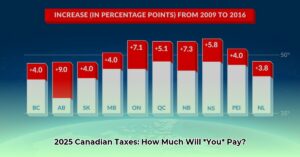

Historical Context and Future Trends

While this guide focuses on 2025, reviewing historical tax bracket data can be insightful. Comparing how brackets and rates have changed over time provides context about the impacts of inflation, economic conditions, and government policy. Some economic analysts suggest that examining such trends can even offer limited insights into potential future tax policy, although it’s important to note that tax laws are subject to change and predictions are not definitive.

Frequently Asked Questions (FAQ)

Q: Are these rates final?

A: No, these are projections based on the expected indexation rate. Consult the CRA website for the latest official information.

Q: What about provincial taxes?

A: Provincial/territorial taxes are separate and not included here. Refer to your province/territory’s website for their specific rates.

Q: Where can I find eligible deductions and credits?

A: The CRA website offers comprehensive information on deductions and credits.

Disclaimer: This guide provides general information and does not constitute professional tax advice. Consult with a qualified tax advisor for personalized guidance. Last updated: November 2024.