Decoding TikTok’s 2025 Value: The Algorithm Question

In 2025, TikTok faced intense scrutiny, particularly in the U.S., due to concerns surrounding its Chinese ownership and data security. A key question emerged: what would TikTok be worth without its powerful algorithm? This question became central to discussions about the platform’s future, including potential sales and regulatory actions. This article delves into the complexities of this valuation debate, exploring the various estimates, the political and economic context, and the lasting implications for TikTok and the broader social media landscape.

The Valuation Puzzle: 2025 Estimates

Estimating TikTok’s value in 2025, stripped of its algorithm, proved challenging. The algorithm, after all, is the engine driving user engagement and targeted advertising—the lifeblood of the platform. Several valuations emerged, painting a fragmented picture:

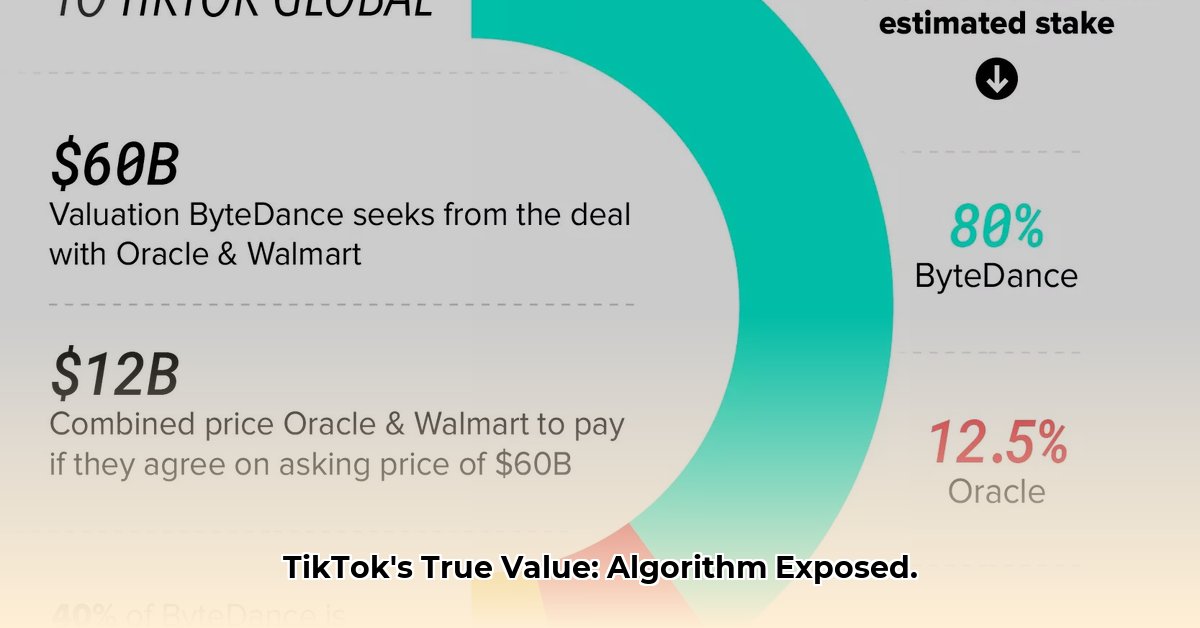

- Frank McCourt’s Offer: A $20 billion bid from former Los Angeles Dodgers owner Frank McCourt, specifically for TikTok’s U.S. operations excluding the algorithm, set a baseline. This bid, although initially from 2024, continued to be referenced in 2025 discussions.

- Analyst Estimates: Analyst estimates presented a wider range. Mark Zgutowicz of Benchmark suggested a $55 billion valuation (without the algorithm), while Dan Ives of Wedbush placed the figure between $40 and $50 billion.

| Valuation (Without Algorithm) | Source | Amount (USD) |

|---|---|---|

| McCourt Offer (2024/2025) | Public Reports | $20 Billion |

| Zgutowicz Estimate (2025) | Public Reports | $55 Billion |

| Ives Estimate (2025) | Public Reports | $40-$50 Billion |

These discrepancies highlight the difficulty of assessing the algorithm’s contribution. Some argued that without its personalized feed, TikTok would become just another video-sharing platform, significantly diminishing its value. Others maintained that the platform’s user base and brand recognition held inherent value, even without the algorithmic magic.

The Algorithm’s Power: Why It Mattered

TikTok’s algorithm is its secret sauce. It curates personalized content feeds, driving user engagement and making the platform highly addictive. This personalized experience is also what attracts advertisers. Removing the algorithm raises crucial questions: Could TikTok replicate its success without it? Could another company replicate the algorithm’s effectiveness? The likely answer to both questions, in 2025, was a resounding “no”. The algorithm represented years of development and refinement, a competitive advantage difficult to replicate.

The Political and Economic Maelstrom of 2025

The geopolitical climate of 2025 significantly impacted TikTok’s valuation. The potential for a U.S. ban on the platform, driven by national security concerns and data privacy issues, loomed large. This threat created uncertainty for investors and likely depressed the platform’s perceived value. A forced sale, especially one excluding the algorithm, would have had devastating financial consequences for TikTok, impacting creators, advertisers, and the company’s future prospects. Competitors like Instagram Reels and YouTube Shorts stood ready to absorb TikTok’s user base should the platform falter.

The Aftermath: TikTok Post-2025

The 2025 valuation debates had a lasting impact on TikTok’s trajectory. While the exact financial details remain undisclosed, the discussions highlighted the algorithm’s central role in the platform’s success. The subsequent years saw TikTok navigating a complex regulatory landscape, further underscoring the interplay between technology, politics, and economics in the digital realm. The 2025 events emphasized the inherent challenges of valuing a platform heavily reliant on proprietary algorithms and subject to geopolitical pressures.

The Future of Platform Valuation

The TikTok case study offers valuable insights into the future of platform valuation. It demonstrates the increasing importance of intangible assets, like algorithms, in the digital economy. It also reveals the vulnerability of global platforms to geopolitical forces. As technology continues to evolve, so too will the methods for assessing the value of digital platforms, considering the interplay of technology, user engagement, and political and economic factors. The questions raised in 2025 continue to resonate, shaping the ongoing dialogue about the true worth of digital platforms in an increasingly complex world.